risk management overview

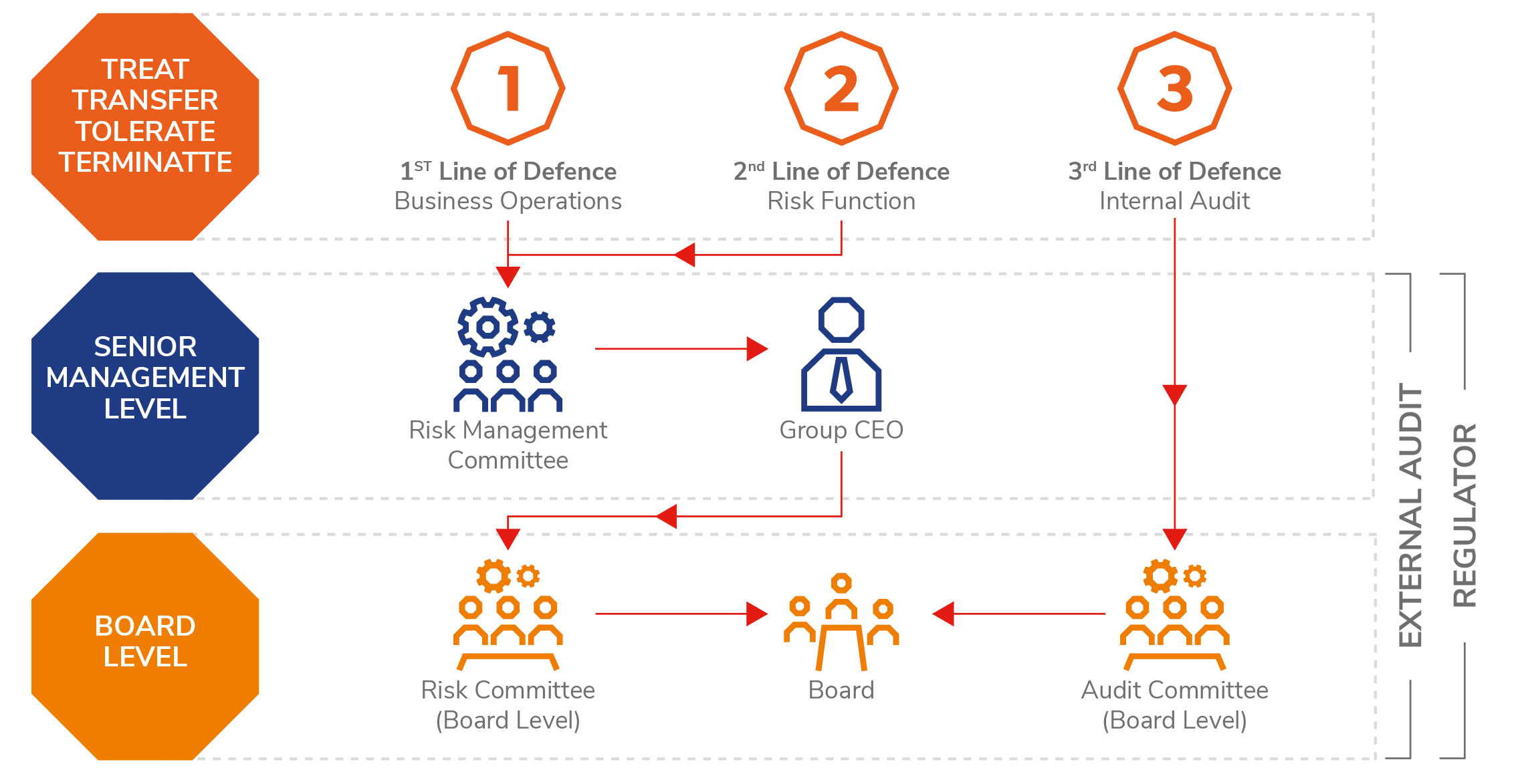

The Group has a defined step by step approach with respect to risk management. The above diagram illustrates the high level process, whereby risks can be managed through the 4 T’s, at each step.

- TREAT: Take action to control the risk either by reducing the likelihood of the risk developing or limiting the impact it will have on the project.

- TRANSFER: Some of the financial risks maybe transferable via insurance or contractual arrangements or accepted by third parties.

- TOLERATE: Nothing can be done at a reasonable cost to mitigate the risk or the likelihood and impact are at reasonable level.

- TERMINATE: Do things differently and remove the risk.

risk management responsibilities

MUA has adopted the ‘three-lines-of-defence’ model where ownership for risk is taken at all levels in the Group. This model is widely adopted by financial services companies globally. It clearly sets out the risk management responsibilities across the business and is consistent with the current regulatory risk-based approach, encompassing corporate governance, processes and controls.