group profile

MUA Ltd (‘MUA’ or ‘the Company’) is a public company listed on the Official List of the Stock Exchange of Mauritius (‘SEM’) as from the 8th January 2019 and is a Public Interest Entity as defined by the Financial Reporting Act 2004.

The Board of Directors (‘Board’) of MUA is committed to uphold the highest standards of integrity, accountability and transparency in the governance of MUA and its subsidiaries (‘MUA Group’ or ‘the Group’) and acknowledges its responsibility for applying and implementing the eight principles set out in the National Code of Corporate Governance (2016) (‘the Code’) as explained in appropriate sections of the Annual Report:

- Governance Structure

- The Structure of the Board and its Committees

- Director Appointment Procedures

- Director Duties, Remuneration and Performance

- Risk Governance and Internal Control

- Reporting with Integrity

- Audit

- Relations with Shareholders and Other Key Stakeholders

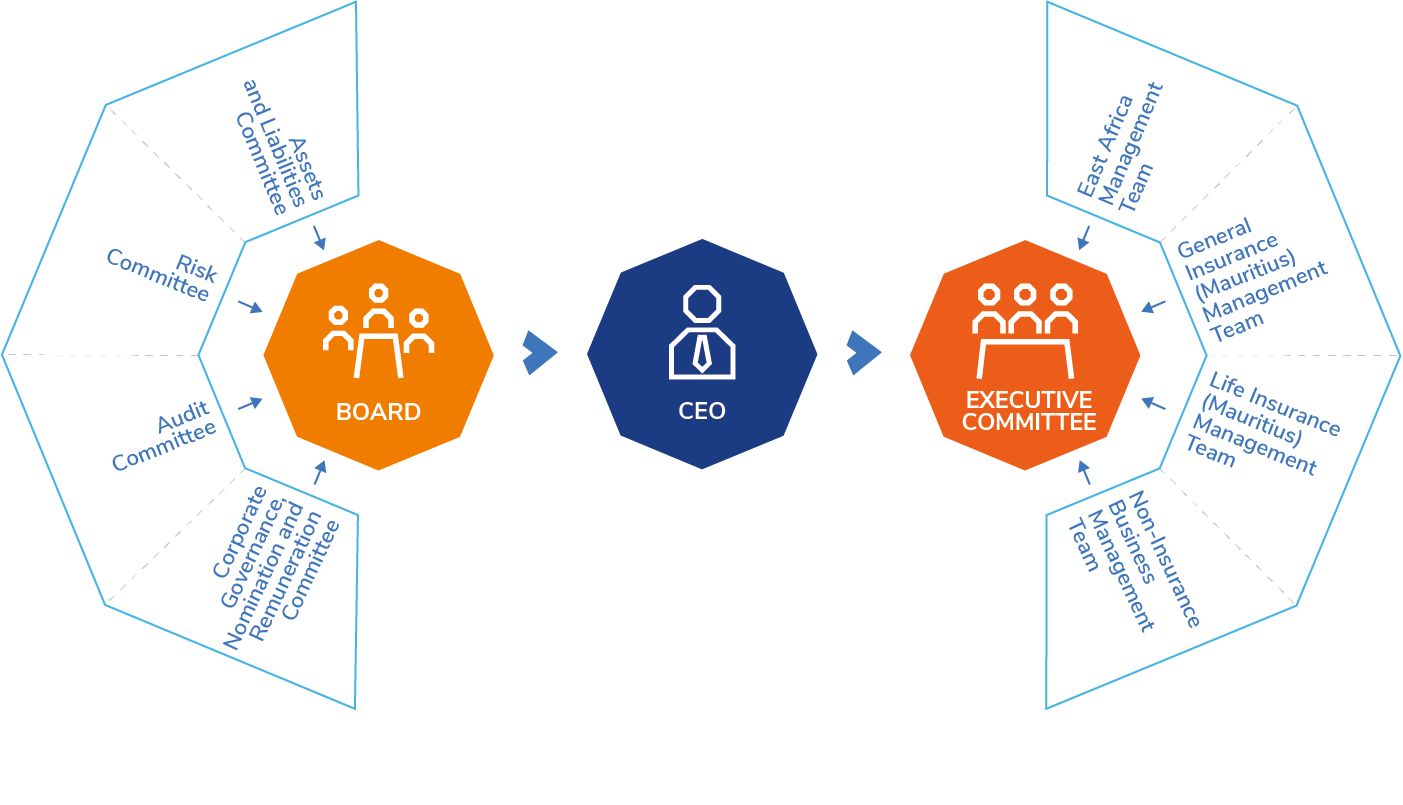

GOVERNANCE structure

The Role of the Board

The Board is responsible for leading effectively the Group and the Company by establishing strategies and policies to enhance the long-term value for its shareholders and other stakeholders.

The Board validates and monitors strategies, policies and business plans as well as considers all statutory matters, including the approval of financial statements, the declaration of dividends, the review of the Company’s performance through budgets and forecasts and the Chief Executive Officer’s report. It also ensures that all legal and regulatory requirements are met.

structure of board and committees

Board Size and Structure

The Company’s constitution states that the Board shall consist of a minimum of seven and a maximum of twelve Directors. As at 31 December 2019, the Company was headed by a unitary Board consisting of ten Directors, four of whom are Independent Non-Executives, four Non-Executives and two Executives.

The Directors come from different professional backgrounds with varied skills, expertise and strong business experience. Taking into account the sophistication of the Group’s operations, the Board is satisfied that its actual size and composition is well balanced for it to assume fully its responsibilities while discharging its duties effectively. The Board Charter stipulates that composition of the Board shall include at least two Executive Directors, two Independent Directors and gender balance with at least one female Director.

| Directors | Category | Date Appointed | Gender | Country of Residence | Board Attendance |

|---|---|---|---|---|---|

| Vincent Ah Chuen * | NED | 2019 | M | Mauritius | 5/6 |

| Alfred Bouckaert | IND | 2019 | M | Belgium | 6/6 |

| Bertrand Casteres – Chief Executive Officer | ED | 2018 | M | Mauritius | 6/6 |

| Mélanie Faugier | NED | 2019 | F | Mauritius | 6/6 |

| Bruno de Froberville | NED | 2019 | M | Mauritius | 4/6 |

| Dominique Galea * – Chairman | NED | 2018 | M | Mauritius | 6/6 |

| Angelo Letimier (up to 28 June 2019) | IND | 2019 | M | Mauritius | 1/6 |

| Catherine McIlraith | IND | 2019 | F | Mauritius | 4/6 |

| Ashraf Musbally | ED | 2019 | M | Kenya | 5/6 |

| Mushtaq Oosman | IND | 2019 | M | Mauritius | 5/6 |

| Olivier De Grivel (as from 14 May 2019) | IND | 2019 | M | Mauritius | 5/6 |

| *Brian Ah-Chuen (Alternate to Vincent Ah-Chuen) | 2019 | M | Mauritius | N/A | |

| *Antoine Galea (Alternate to Dominique Galea up to 14 May 2019) | 2019 | M | Mauritius | N/A | |

| *Celine Gormand (Alternate to Dominique Galea as from 28 January 2020) | 2020 | F | Mauritius | N/A |

*Definitions: NED: Non-Executive Director – IND: Independent Non-Executive Director – ED: Executive Director

director's profile

Dominique Galea

Chairman, Non-Executive Director

Bertrand Casteres

Executive Director And Group CEO

Vincent Ah Chuen

Non-Executive Director

Alfred Bouckaert

Independent Non-Executive Director

Bruno De Froberville

Non-Executive Director

Mélanie Fraugier

Non-Executive Director

Olivier De Grivel

Independent Non-Executive Director

Angelo Letimer

Independent Non-Executive Director

Catherine Mcilraith

Independent Non-Executive Director

Ashraf Musbally

Executive Director And CEO Kenya & East Africa

Mushtaq Oosman

Independent Non-Executive Director

Brian Ah Chuen

Alternate Director

Antoine Galea

Alternative Director

Celine Gormand

Alternative Director

executive comitee

Delphine Ahnee

Head Of Group Risk, Legal & Customer Care

Mehtab Aly

Head Of Mergers, Acquisitions & Capital Management

Nathalie André

Group Head Of Human Resources

Jean Christophe Cluzeau

Head Of General Insurance

Sin Cham (Laval) Foo-Kune

Group Chief Finance Officer

Naresh Gokulsing

Managing Director Life & Pension

Gaudens Kanamugire

Managing Director, Rwanda

Jérôme Katz

Head Of Group Strategy & Investment

Clarel Marie

General Manager - Life Insurance Operations

Latimer Kagimu Mukasa

Managing Director, Uganda

Rishi Sewnundun

Head Of Group Information Sytems & Logistics

Pradeep Kumar Srivatava

Ceo - Phoenix Of Tanzania Assurance Co

Kenny Wong

Head Of Group Reinsurance & Special Risks