financial highlights

Gross Earned Premium (Rs m)

2017

2018

2019

Group Revenue

General Insurance Mauritius (Rs m)

2017

2018

2019

Life Insurance Mauritius (Rs m)

2017

2018

2019

General Insurance East Africa (Rs m)

2017

2018

2019

Group Profit After Tax (Rs m)

2017

2018

2019

PAT by region

44%

Mauritius - General Insurance

32%

Mauritius - Life + Others

24%

East Africa

Group Return on Equity

2017

2018

2019

Earnings per share (Rs)

2017

2018

2019

General Insurance - Mauritius

Market Share: in terms of Gross Premiums*

Motor: 23% market share – No. 1

Accident & Health: 23% market share – No. 2

Property: 23% market share – No. 2

Overall: 25% market share – No. 2

* Latest available FSC statistics 2018.

General Insurance - East Africa

Life Insurance - Mauritius

Gross Written Premium

2017

2018

2019

Profit After Tax (Rs m)

2017

2018

2019

value creation model

our vision creating value for stakeholders

purpose |

|---|

|

Ensure peace of mind for our customers by providing the best financial protection and solutions through |

MUA is driven to creating and sharing value amongst all of its stakeholders by focusing on sustainable social, economic and environmental value. It is our core belief that as a responsible insurance group, we have the moral obligation to ensure the peace of mind of our customers, to enable healthier and happier lives for our employees and to participate in the development of the communities we serve.

Our Employees |

|---|

|

Our people are our strongest asset. Our motto is to go beyond simply attracting, developing and retaining a diverse, qualified and motivated workforce, but to create instead a great place to work where our employees feel a strong sense of belonging to the MUA family, are empowered, recognized and encouraged to achieve their full potential. |

Our Customers |

|---|

|

We are strongly committed to delivering service excellence. We strongly believe that a customer who has been well-advised about the insurance product during the purchase stage and who has been well-assisted during the claim process is a customer that we gain for life. We want to be positioned as the lifelong insurance partner who looks after their needs diligently. |

Our Communities |

|---|

|

We are focused on bringing tangible and intangible value to our communities by delivering a clear, well-articulated value proposition which replies well to their needs. By providing insurance that adequately protects them from the risks and perils of life, we contribute to a continuously thriving society. |

Our Shareholders |

|---|

|

Backed by our strong business model and prudent risk management approach, we have consistently delivered sustainable growth and superior returns in the form of share price appreciation and dividends to our shareholders over the years. |

MUA Ambition 2020

MUA Ambition 2020 is the 2018 – 2020 Strategic Plan of the Group that acts as a comprehensive framework guiding the fast-paced development and transformation of all its entities.

The plan is underpinned by four key strategic pillars, two of which are led at a Group level.

REGIONAL GROUP CULTURE |

|

|---|---|

regional |

‘Regional Group Culture’ is about bringing all the entities of the Group together as one family which shares similar values, culture and branding ethos. |

REGIONAL GROUP CULTURE |

|

|---|---|

CAPITAL & |

The second Group-wide strategic focus area is on a prudent Capital & Risk Management Approach. We strongly believe in achieving a harmonious fit between our capital resource allocation frameworks, our risk appetite and the returns generated. |

In addition, we also have two other strategic pillars that each entity applies as per its respective business context. This approach allows for enhanced flexibility, agility and cultural sensitivity in the interpretation of our strategic model.

BUSINESS GROWTH |

|

|---|---|

BUSINESS GROWTH |

This strategic pillar focuses on delivering a sustainable growth trajectory despite challenging market conditions. Each entity develops a set of business development initiatives to maintain our growth trajectory. |

BUSINESS TRANSFORMATION |

|

|---|---|

BUSINESS |

Our aim is to transform from being a transactional and disconnected financial services provider towards becoming a full-fledged partner enabling our clients to live their best life. The first stepping stone to this journey is already underway and is focused on creating simple & affordable products and a fast, transparent and hassle-free claim experience. |

The four pillars ultimately rest on a commitment to foster a customer-centric approach across all levels of the Group. The client must remain at the heart of all our endeavors and solutions.

Value Creation process

sustainability

Investing in our staff

Investing in our customers

Sept2018

Sept2019

Sept2018

oct2019

Launch of Client Portal

In our ongoing quest for digital innovation and to provide our clients with practical tools to simplify their lives, MUA has launched its new client portal. Clients can now manage all their general insurance policies online, including renewing their insurance, submitting and follow-up of their claims as well as settling their account on one easy and dedicated platform.

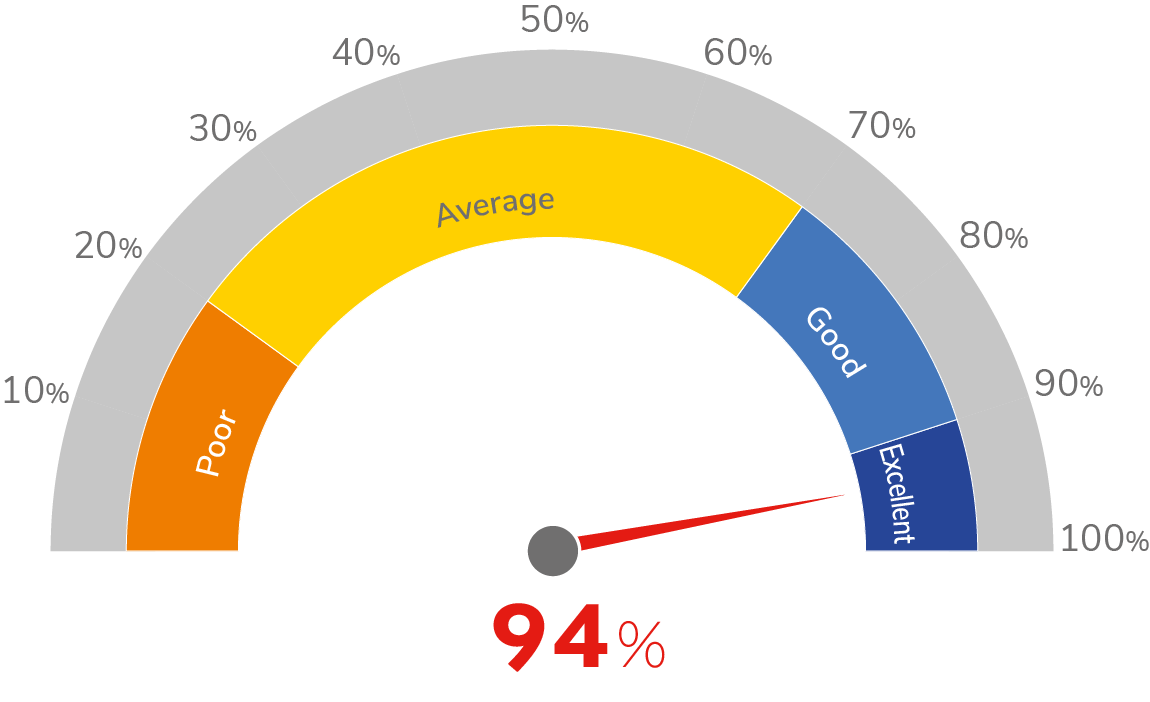

Happy or Not

Happy or not terminals are located in all our branches and two offices in Mauritius. In 2019, the overall satisfaction level of our clients was 94%.

Investing in our environment

Electricity consumption:

No. of KWh

2017

2018

2019

Total cost (Rs)

2017

2018

2019

Paper consumption:

Types of paper most commonly used across the Group

2017

2018

2019

No. of sheets

2017

2018

2019

Investing in the community

Rs1,402,462

Direct Charitable Contributions from MUA Foundation*

Rs1,780,588

Disbursed to MRA to support National Social Inclusion Foundation

Rs3,183,050

Total contribution to societal causes in 2019