performance& strategy

Financial Highlights 2020

Mauritius – General Insurance

| 2018 (Rs m) |

2019 (Rs m) |

2020 (Rs m) |

|

| Gross Written Premium | 2,253 | 2,350 | 2,497 |

| Net Claims and Benefits | (1,028) | (1,033) | (985) |

| Operations and Administrative Expenses | (745) | (778) | (792) |

| Profit from Operations | 196 | 232 | 311 |

| Profit before Tax | 179 | 212 | 295 |

| Income Tax Expense | (26) | (20) | (38) |

| Profit after Tax | 153 | 192 | 256 |

Market Share: in terms of Gross Premiums*

*Latest available FSC statistics 2019.

- Despite the challenging prevailing market conditions, the positive performance of the general insurance business was driven by good growth in the motor and health segments, combined with lower operating expenses and claims. Operating profits grew by 94%, while the combined ratio declined by 6%. Notwithstanding a two-and-a-half month lockdown, gross premiums earned grew by 3.4%. Travel restrictions, a national lockdown and border closures however adversely impacted the non-motor segments such as travel insurance.

- MUA maintains its focus on digitalisation and innovation, with a number of initiatives going live in 2020: the successful launch of the Client Portal for retail clients; the introduction of a concierge vehicle repair service, providing a hassle-free claims and vehicle repairs process after an accident; automated debtor’s communications; and the implementation of a digital documentation system for brokers.

- The entity’s solvency ratio remains solid at 217%, above regulatory requirements.

- There was a significant increase in visibility and communication during the lockdown, encouraging clients to make use of our online tools and e-commerce platforms. In line with our prevention strategy and road safety initiatives, we launched the Learners' Challenge via social media to encourage young drivers to adopt good driving habits.

Key Focus & Outcomes:

Mauritius – Life Insurance

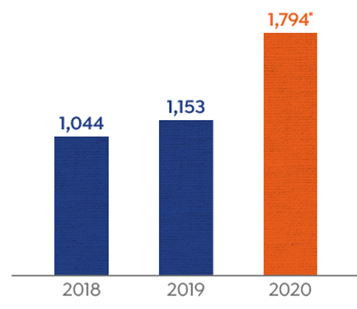

Gross Written Premium (Rs m)

Profit after Tax (Rs m)

- The Life entity’s gross premium grew by 19%, with new business growing by 35% to reach an all time record high despite the lockdown restrictions. The sales teams were able to quickly respond to the constraints during and after the lockdown, maintaining client communication and a high standard of service.

- The good operating results were however significantly impacted by an increase of Rs 108m in reserves, mainly due to lower investment yields, linked to declining interest rates and equity values, in a volatile economic environment as a result of the pandemic. Consequently, net profits declined by 55% compared to 2019.

- Continued focus on digital transformation within the business unit, including internal processes and client facing digital initiatives, aimed at automating administrative tasks. Digital communication channels and tools were used extensively throughout the year, in order to keep MUA’s long-term protection and savings solutions top of mind.

Key Focus & Outcomes:

East Africa – General Insurance

Kenya

Gross Earned Premium: Rs 628m

(includes MUA Kenya & Saham Kenya)

Market share: 2.5%*

*Includes Saham Kenya 1.7%; MUA Kenya 0.5% market share

Out of 38 insurers:

MUA Kenya:

35th Saham Kenya: 22nd

Uganda

Gross Earned Premium: Rs 218m

Market share: 3%*

8thout of 21 insurers

Tanzania

Gross Earned Premium: Rs 524m

Market share: 5%

5th out of 26 insurers*

*General insurance exclude medical to reflect business nature of PTAL

Rwanda

Gross Earned Premium: Rs 215m

Market share: 15%

4th out of 9 insurers

Note: Market share based on latest available figures, in terms of Gross Witten Premium (GWP)

Gross Written Premium (Rs m)

Profit after Tax (Rs m)

Combined Ratio (%)

- 2020 was marked by the acquisition of Saham Kenya from Sanlam Pan Africa, further strengthening MUA's presence in East Africa and sending out a strong signal about the group's confidence in the Kenyan insurance sector.

- Saham Kenya contributed 18% to the total growth of 42% in gross premiums earned by the East African subsidiaries. These results were negatively affected by one-off transaction costs of Rs 24m related to the acquisition of Saham Kenya and Rs 12m of foreign exchange loss on loan from MUA Ltd to finance the acquisition of MUA Kenya. Changes in the accounting policy in Kenya and Tanzania resulted in a further negative impact of Rs 27m, ultimately causing a decrease of 59% in profits after tax.

- The East African region was certainly impacted by the Covid-19 pandemic, with all four of our markets under lockdown and/or sanitary protocol restrictions. Tanzania and Kenya are expected to keep positive growth rates, with minimal growth in Rwanda and Uganda. The reactivity of our various teams meant that they were able to ensure a continuity of service throughout the year despite the lockdown measures.

Key Focus & Outcomes:

MUA Ambition 2020 - Main Achievements

Despite a challenging market context, there was growth and achievement of the 3 year strategic plan.

|

|||

1. COMPLETION OF AMBITION 2020 STRATEGIC PLAN |

|||

|

|||

2. COMPLETION OF REBRANDING EXERCISE ACROSS MOST SUBSIDIARIES |

|||

|

|||

3. SUCCESSFUL REGIONAL EXPANSION |

|||

|

|||

4. SUCCESSFUL INNOVATION AND DIGITALISATION |

|||

|

|||

5. COMPLIANCE TO REGULATORY REQUIREMENTS |

|||

|

|||

6. FULL SUBSCRIPTION OF RIGHTS ISSUE |

|||

|

|||

7. MAINTENANCE OF CARE RATING |

|||

|

|||

Our Value-Creation & Value-Sharing Business Model

| OUR VISION | Creating value for all stakeholders |

| OUR PURPOSE | Ensuring peace of mind for our customers by providing the best financial protection and solutions through innovative products and services in our chosen markets |

At the heart of our vision and mission is the notion of SHARED VALUE – an approach that pushes us everyday to contribute meaningfully and significantly to creating value for ALL, be it:

- The communities in which we operate;

- Our clients who rely on us for their financial protection;

- Our employees who form part of our family and;

- Our shareholders who look for long-term success.

We strongly believe that our success and profitability work in tandem with the advancement of society. As society progresses and grows, so too will our growth opportunities.

COMMUNITY

CUSTOMER

EMPLOYEE

SHAREHOLDER

TRANSITION 2023

Our Strategic Plan for 2021 – 2023 is aptly named TRANSITION 2023 and acknowledges where MUA is in its journey – a transition period, given the high level of global uncertainty and the shift towards embedding sustainability values at the core of our business model.

This critical phase is also in line with our strategic evolution since 2014 and is testimony of our ambitions of establishing MUA as a strong regional player:

2014 – 2017: Focus on transforming our General and Life businesses in Mauritius into highly efficient models with a strong base for further business growth and digital transformation.

2018 – 2020: Focus on creating a strong regional group identity and staff culture, on developing the business significantly in East Africa and on major transformation projects for the Mauritian General and Life businesses.

2021 – 2023: Focus on establishing MUA as a strong and sustainable regional insurance player.

Our Strategic Framework for 2021 – 2023

Our strategic plan has our clients at the heart of our operations.

We endeavour to have a company-wide culture where each member of our team is able to think of the impact on the customer experience before taking a decision.

The model is circular as we strongly believe that we need to have a motivated and engaged workforce to be able to have efficient and effective insurance operations. That in turn will create a positive experience for our clients, and ensuring we make a meaningful contribution to the community by creating real and sustainable value for both our clients and the community. The MUA family will be fully engaged and derive a strong sense of purpose.

TRANSITION 2023 – Our role as a sustainable insurer:

Focus on Prevention, Protection & Investment

Focus on PREVENTION

- Strongly promoting Safe Driving:

- Selecting better risks & encouraging better driving behaviour amongst young drivers

- Encouraging clients to lead a healthier lifestyle

- Helping individuals & companies better prepare for the economic risks they face

Close the PROTECTION gap

- Providing adequate & affordable covers that meet customer needs

- Tangible short term benefits

- Microinsurance, financial planning & wealth management

INVESTMENT

- Socially Responsible Investment (SRI)

- Positive social impact, incorporating ESG (Environmental, Social, Governance) principles into investment decision process

Value Creation Model